EIC Fund - Valuation Methods & Forms of Investment

The European Innovation Council (EIC) Fund is the investment vehicle of the EIC Accelerator programme - the European Commission's flagship innovation funding programme. With a budget of €3 billion from 2021-2027, the EIC Fund is positioned to be one of Europe's largest deep-tech venture capitalists (VCs) during this period. Through the structure of the fund, a minimum of €3 billion of private funds will be invested alongside the EIC Fund during this period. The EIC aspires to crowd in a further €30bn-€50bn as one of its six strategic goals.

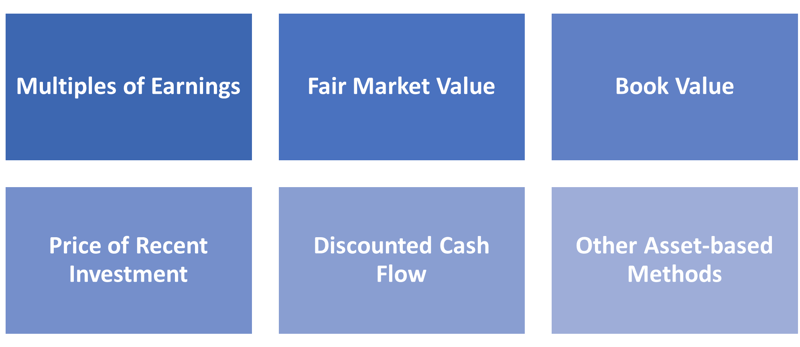

Valuation Methods

In most cases, the EIC Fund will not be valuing companies which apply for funding via the EIC Accelerator programme. For the purpose of equity investment, the EIC Fund will generally adopt the valuation as set out by the private co-investor(s) since this would represent a market value.

A non-exhaustive list of valuations methods used by the private market can be found below:

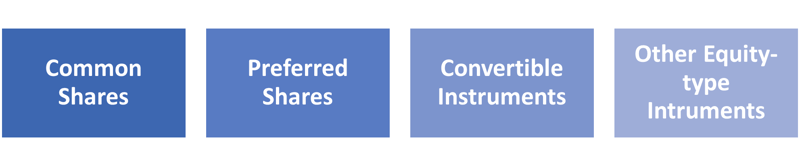

Possible Forms of Investment (Equity or Equity-type Investments)

As stated in the Investment Guidelines document, "The financial instruments used by the EIC Fund will take, in priority, the form of equity or quasi-equity investments".

A list of standard equity and quasi-equity investments can be found below:

Read more: https://landing.winnovart.com/eic-fund-valuation-methods-forms-of-investment

For ongoing updates about the EIC Fund, you can subscribe to our regular updates, please get in touch with us, or follow us on Facebook, LinkedIn, Twitter.