EEA&Norway grants statistics – Competition results SMEGrowth programme in Romania (2018)

At, Winnovart, it is part of our mission to bring transparency in the grants-based market space. We do this in the funding areas and for the funding mechanisms we are working with. This is why we are introducing a very comprehensive analysis of the EEA&Norway grants statistics available so far (the business programmes operated by Innovation Norway). We believe this might be the most comprehensive analysis so far on the market and we trust this will enable you to make better decisions when applying for funding under this mechanism.

Based on the competition results and other official statistics published by the Fund Operator, we are reviewing: the real level of budget allocation vs the initial budget announced for the competition; real budget allocation across the programme focus areas and funding streams; average funding intensities; projects distribution between focus areas and funding streams. The analysis presents data and conclusions that might be different to what the competition call and guidelines were presenting upon the programme launch.

This is our analysis of the SMEGrowth programme in Romania, 2018 competition, based on the final results published by the Fund Operator during 2020.

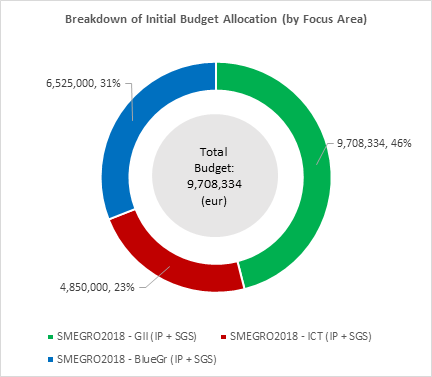

1. Initial programme budget at the opening of this competition (2018)

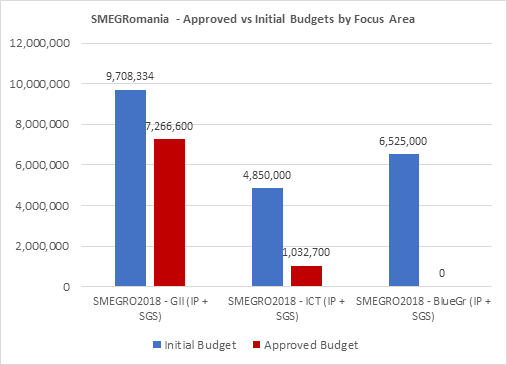

Upon programme launch and opening of the 2018 call, the total budget announced by the Fund Operator was approx. 21 million euros. The budget breakdown followed the 3 programme focus areas (Green Industry Innovation, ICT, Blue Growth): 46% of the budget was allocated to Green Industry Innovation (9.7 million euros); 23% to ICT (4.85 million euros), 31% to Blue Growth (6.5 million euros).

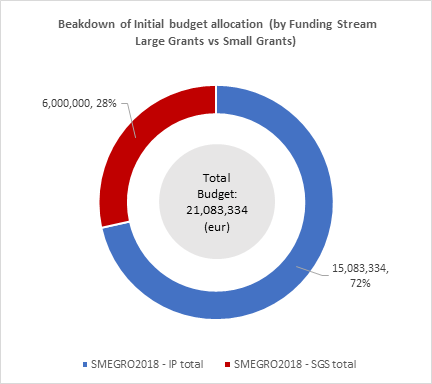

Initial budget allocation between the Small Grants Scheme (SGS) and the Large grants scheme (Individual Project Scheme – IPS): 72% of the budget (15 million euros) allocated to the IPS, 28% of the budget allocated to the SGS (6 million euros).

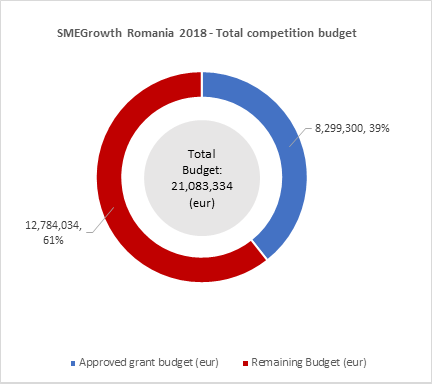

2.Overall budget spending after the first call of the competition

The initial total budget for the programme call was 21 million euros. Out of this, only 39% (8.3 million euros) have been awarded as grants to selected beneficiaries. A remaining 61% or 12.8 million euros of the total budget have not been awarded.

We would expect the Fund Operator to re-allocate this budget to upcoming calls of this competition, but this is yet to be officially confirmed.

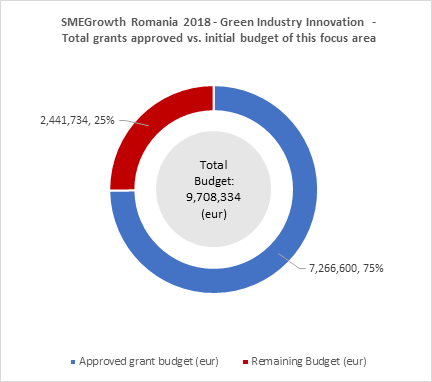

3. Budget spending by programme focus area.

The budget for the focus area – GII (initial budget 9.7 million euros). 75% of this budget has been allocated/ awarded as grants to the selected beneficiaries. There is a remaining 2.45 million euros (25% of the budget), that have not been awarded.

We would expect the Fund Operator to re-allocate this budget to upcoming calls of this competition, but this is yet to be officially confirmed.

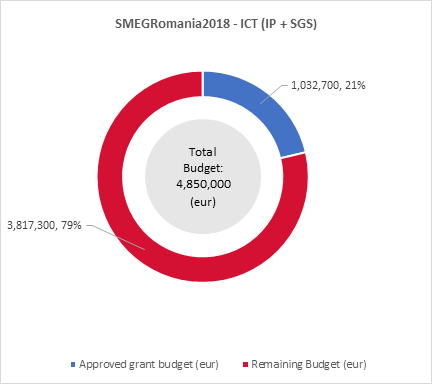

The budget for the focus area – ICT (initial budget 4.9 million euros). 21% of this budget has been allocated/ awarded as grants to the selected beneficiaries. There is a remaining 3.8 million euros, or 79% of the total budget, that have not been awarded

We would expect the Fund Operator to re-allocate this budget to upcoming calls of this competition, but this is yet to be officially confirmed.

An overview of the budget spending by focus area – for Green Industry Innovation, most of the budget has been allocated/ awarded, while for ICT the majority of the budget remains unspent/un-allocated. Blue Growth has had no approved projects; thus, they have the entire allocation as remaining budget. Altogether, 12.8 million euros of the total budget have not been awarded after the first call of the programme (2018), out of a total budget of approx. 21 million euros.

We would expect the Fund Operator to re-allocate this budget to upcoming calls of this competition, but this is yet to be officially confirmed.

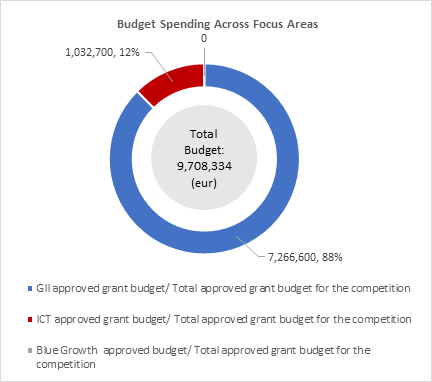

4. Budget spending across focus areas

The budget spending across focus areas. 88% or 7.3 million euros, of the total approved budgets went to green industry and innovation. 12% or 1 million euros, of the total budget were allocated to ICT. Blue growth did not have any projects approved/ no budget awarded.

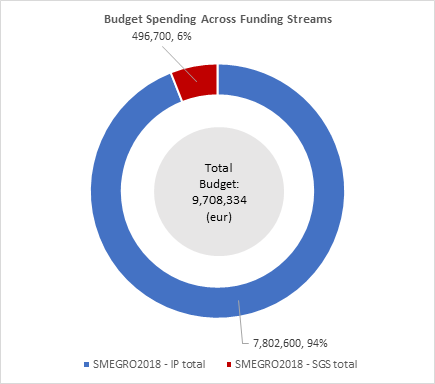

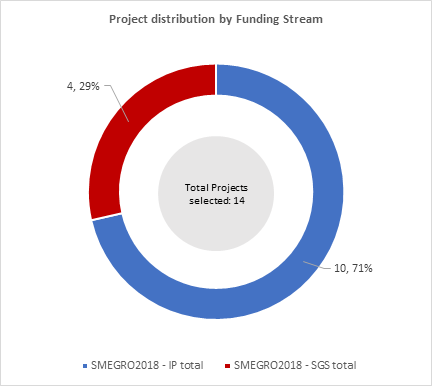

5. Budget spending across the funding streams

The programme allocates funding through 2 funding streams: the large grants scheme offering grants up to 2 million euros/ project, and the small grants scheme offering grants up to 200k euros/ project. The budget spending across these 2 funding streams: 94% or 7.8 million euros of the total budget approved, were allocated to the large grants scheme. 6% or 0.5 million euros of the total approved budget, were allocated to the small grants scheme.

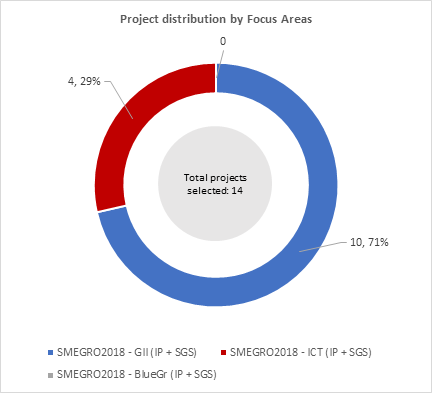

6. Project count/distribution by focus area

There have been a total of 14 projects approved for this call. The green industry and innovation focus area had 10 projects approved, while the ICT focus area had 4 projects approved. Blue growth had no projects approved for this call.

Of the 14 projects approved, 4 where part of the small grant scheme while 10 of those were part of the individual project scheme.

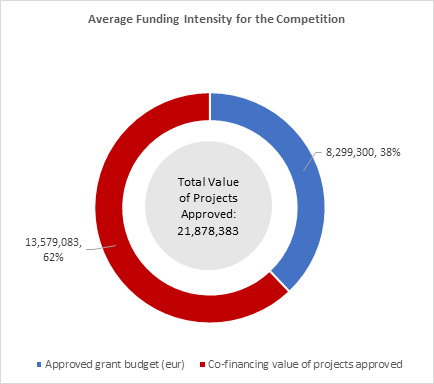

7. Funding intensity analysis

The average funding intensity for the competition, by comparing the total value of approved grants vs. the total value of approved projects. The average funding intensity of this call/ competition was 38%. As a note, the highest funding intensity of an individual project was 63%, while the lowest was 28%. This means that altogether, 62% of the total value of approved projects, i.e. 13.5 million euros will be co-financed by the beneficiary companies, from own resources/ bank financing.

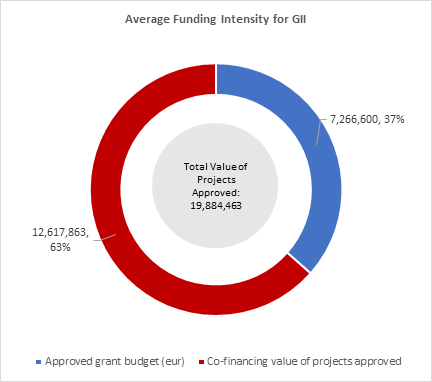

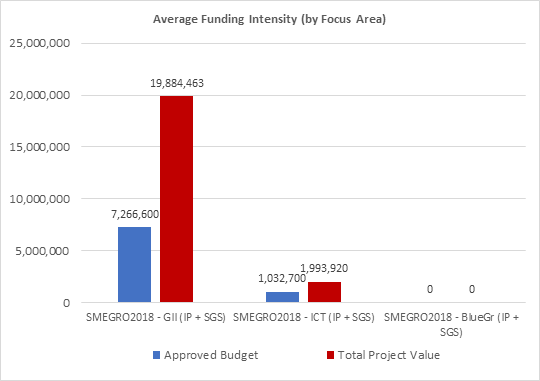

Funding intensity analysis by focus area: GII, ICT, Blue Growth

Average funding intensity for Green Industry Innovation: 36% (total grants approved = 7,266,600 vs. total value of selected projects = 19,884,463)

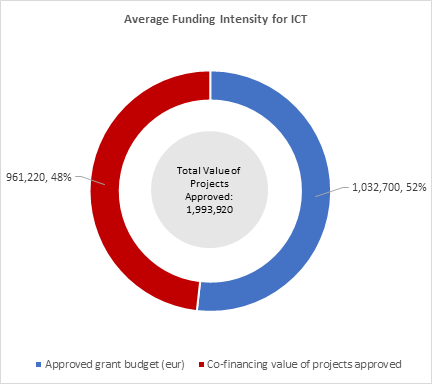

Average funding intensity for ICT: 52% (total grants approved = 1,032,700 euros vs total value of selected projects = 1,993,920 euros)

Overview of funding intensity across focus areas.

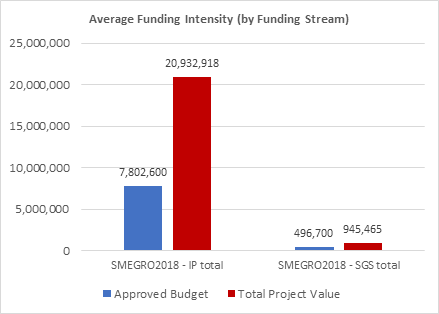

Funding intensity analysis by funding stream: Large grants scheme vs Small grants scheme

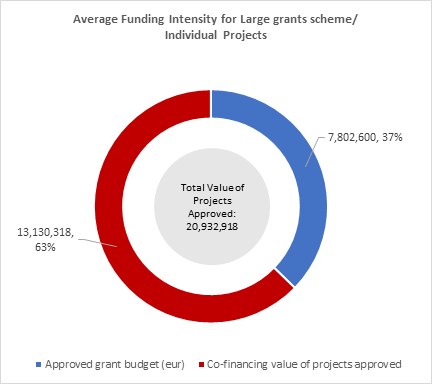

Average funding intensity for the Large grants scheme: 37%

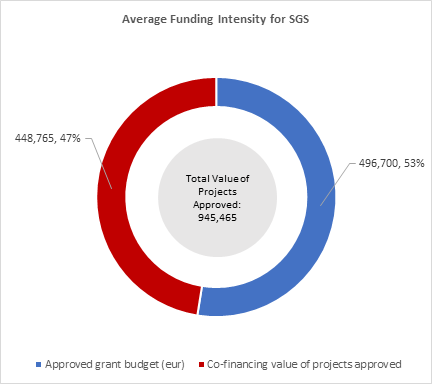

Average funding intensity for the Small grants scheme: 53%

Overview of funding intensity across funding streams

Competition timeline, consistency and transparency profile:

| Details | Status | Date | Comments |

|---|---|---|---|

| Competition launch | Yes | May2018 | N/a |

| Deadline extension after launch | No | N/a | N/a |

| Competition deadline | Yes | 1 Nov 2018 | N/a |

| Competition statistics published after submission deadline | No | N/a | N/a |

| Communication of results to individual applicants | Yes | Q4 2019 | N/a |

| Official publication of results (website and or/ other media) | Yes | Q2 2020 | Link to published results |

| Publication of score and score-based ranking | No | N/a | Despite a detailed scoring scheme as part of the guidelines, the Fund Operator doesn’t use to publish score-based ranking list |

| List of applicants published | No | N/a | N/a |

| List of selected beneficiaries published (all consortium partners) | Yes | Link to published results | |

| Full details about project title, budget, partner roles and budget breakdown between partners | Yes/No | Budget breakdown between partners not available. |

The presentation of the 2018 competitions of SMEGrowth Romania is here.